Introdution

Economic Forces

The economic forces have a tremendous impact on businesses. This factors influence levels of production and demand for goods and services. As well this economic variables represent opportunities and threats for organization.

For organization to be able to work properly and achieve great success, they must seek information concerning the economic variables that affect their surroundings.

Shift to a service economy in Colombia

The world economy is increasingly characterized as a service economy. This is primarily due to the increasing importance and share of the service sector in the economies of most developed and developing countries. In fact, the growth of the service sector has long been considered as an indicator of a country's economic progress. Economic history tells us that all developing nations have invariably experienced a shift from agriculture to industry and then to the service sector as the mainstay of the economy. This shift has also brought about a change in the definition of goods and services themselves.

Service organizations vary widely in size. At one end of the scale are huge international corporations operating in such industries as airlines, banking, insurance, telecommunications, and hotels. At the other end of the scale are a vast array of locally owned and operated small businesses, such as restaurants, laundries, optometrists, beauty parlors, and numerous business-to-business services.

The service sector is going through revolutionary change, which dramatically affects the way in which we live and work. New services are continually being launched to satisfy our existing needs and to meet needs that we did not even know we had. Nearly fifty years ago, when the first electronic file sharing system was created, few people likely anticipated the future demand for online banking, website hosting, or email providers. Today, many of us feel we can't do without them. Similar transformations are occurring in business-to-business markets.

References:

The Service Economy. (2015). Boundless. Retrieved from https://www.boundless.com/marketing/textbooks/boundless-marketing-textbook/services-marketing-6/the-importance-of-services-48/the-service-economy-241-7992/

Availability of credit

It refers to the amount of credit to which a borrower has access at an specific time. It describes the capacity to obtain resources by borrowers, with normal levels of risk. Access to credit is good for economic development, since it allows new investments to exist, and allows people to purchase more things. However, excessive lending can end up in financial crises.

Domestic credit to private sector refers to financial resources provided to the private sector by financial corporations, such as through loans, purchases of non equity securities, and trade credits and other accounts receivable, that establish a claim for repayment. For some countries these claims include credit to public enterprises. The financial corporations include monetary authorities and deposit money banks, as well as other financial corporations where data are available (including corporations that do not accept transferable deposits but do incur such liabilities as time and savings deposits). Examples of other financial corporations are finance and leasing companies, money lenders, insurance corporations, pension funds, and foreign exchange companies.

References:

Data.worldbank.org,. (2016). Domestic credit to private sector (% of GDP) | Data | Table. Retrieved 17 February 2016, from http://data.worldbank.org/indicator/FS.AST.PRVT.GD.ZS/countries

Level of disposable income

This force refers about how people prefer spend more in goods and services than save the money. Also, the fact that consumer decides in how want to spend money, helps to the economy, increase the employee rate, the supply and demand increase.

Now days, technology is a good tool and make our lives pretty easy. The fact that we can buy by Internet is a good way to be more prone to spend. Colombia is 14 points below than the average in Latin America, but the expectations are that it will increase in an 18% between 2013-2018, according to ranking e-Readness.

Middle class is increasing, represents the 37% of population in Colombia, they moves the economy of a country because it consumes more than the 50% buying in neighborhood stores, bakery and around the 30% goes to supermarkets.

When people are propensity to spend is a good opportunity for the company and the industry, because they will prefer to spend money related on leisure and spend time with friends, family, and love ones.

References:

Euromonitor.com,. (2016). Tea in Colombia. Retrieved 17 February 2016, from http://www.euromonitor.com/tea-in-colombia/report

Euromonitor.com,. (2016). Income and Expenditure: Colombia. Retrieved 17 February 2016, from http://www.euromonitor.com/income-and-expenditure-colombia/report

Propensity of people to spend

This force refers about how people prefer spend more in goods and services than save the money. Also, the fact that consumer decides in how want to spend money, helps to the economy, increase the employee rate, the supply and demand increase.

Now days, technology is a good tool and make our lives pretty easy. The fact that we can buy by Internet is a good way to be more prone to spend. Colombia is 14 points below than the average in Latin America, but the expectations are that it will increase in an 18% between 2013-2018, according to ranking e-Readness.

Middle class is increasing, represents the 37% of population in Colombia, they moves the economy of a country because it consumes more than the 50% buying in neighborhood stores, bakery and around the 30% goes to supermarkets.

When people are propensity to spend is a good opportunity for the company and the industry, because they will prefer to spend money related on leisure and spend time with friends, family, and love ones.

References:

Interest rates

Inflation rates

Interest rates are the price of the money on the market. Is the same as a product, when is more money the rate is low, but if is less on market the rate is high. It is a good way to control inflation rate.

The middle class led to rise in demand for credits. "The consume credits in Colombia increase in a real rate of 9,22%, microcredit 7,25% living places reach 14,5%", according to Superfinanciera.

Its important to see how the interest rates changes because is how we can take in count if ask for a loan or not. The idea is to have a stable rate because this is how firms can invest in a resource.

References:

Inflation Rates are the ones at which the general level of prices for goods and services are rising, and consequently, the purchasing of currency is falling. Banks attempted to limit inflation. In Colombia, 2015 was an expensive year, inflation raises 6,77% the highest number registered since 2009, and 3,11% more than 2014.

Inflation Rate in Colombia is expected to be 7.68 percent by the end of this quarter, according to Trading Economics global macro models and analysts expectations.

A large percentage of food and drinks are imported, it means the products are more expensive, increasing the inflation and devaluate the Colombian peso. This could have serious effects in the industry because will start buying less products since the prices are getting higher.

References:

Tradingeconomics.com,. (2016). Colombia Inflation Rate Forecast 2016-2020. Retrieved 17 February 2016, from http://www.tradingeconomics.com/colombia/inflation-cpi/forecast

http://www.indexmundi.com/g/g.aspx?c=co&v=71&l=es

Money market rates

Is used by participants for borrowing and lending money in a short term, several days or just under a year. It decides whether to access in a short-term credit, if is expensive or not in a country. It is a supply and demand case, if the credit is high, demand will be lower, and vice versa.

If rates are low, a short-term credit can be bought and sell easily. A rise in interest rates is used to stop inflation and protect currency. Colombia, in the last year, has raised its money market rates by 0.25 points, from 4.25% to 4.50% annually.

References:

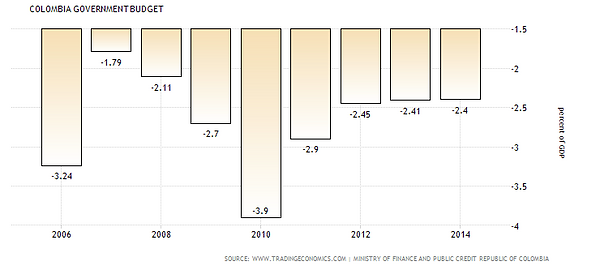

Federal government budget deficits

“Most commonly used to refer to government spending rather than business or individual spending. When referring to accrued federal government deficits, the term "national debt” is used.”

A budget deficit occurs when a government spends more money than it takes in.

In October 2015 Colombia's foreign debt reaches 110.423 million dollars, representing an increase about 10%. This was stated in a report from the Bank of the Republic, which states that foreign debt represents 25.81% from the gross domestic product, which reached the highest level in the last 10 years.

Colombia’s total external debt contains approximately 60% in public debt and 40% in private debt. Colombia recorded a Government Budget deficit equal to 2.40 percent of the country's Gross Domestic Product in 2014.

It is necessary to know the importance of this economic force for our country and the industry itself. A rise in the GDP can cause several effects in Colombia’s economy for example; there would be higher debt interest payments increasing our interest rates and also it would be necessary to increase taxes in order to reduce the deficit. All this brings inflation to our economy due to the harsh situation that we are living.

References:

Finance & Development | F&D,. (2016). Finance & Development. Retrieved 5 February 2016, from http://www.imf.org/external/pubs/ft/fandd/basics/gdp.htm

Tradingeconomics.com,. (2016). Colombia Government Budget | 2001-2016 | Data | Chart | Calendar | Forecast. Retrieved 8 February 2016, from http://www.tradingeconomics.com/colombia/government-budget

Colombiareports.com,. (2015). Colombia's external debt grew to record levels in 2014: Central Bank. Retrieved 5 February 2016, from http://colombiareports.com/colombias-external-debt-grew-record-levels-2014-central-bank/

Gross domestic product trend

Is the monetary value of all the finished goods and services produced within a country's borders in a specific time period.

The GDP is the most important indicator to capture these economic activities helping us to have a clear vision of whether it would be good to buy new equipment for expanding our operations.

The Gross Domestic Product (GDP) in Colombia expanded 1.20 percent in the third quarter of 2015 over the previous one. “Colombia’s industrial sector has been an important and consistent contributor to the nation’s gross domestic product. The industrial sector has contributed an average share of 34% to the Colombian GDP in the last 35 years, and the service sector of Colombia provides employment to 67% of the country’s workforce and contributes 55% to its gross domestic product”

References:

Munoz, S. (2016). Colombia Posts 3.2% Quarterly GDP Growth. WSJ. Retrieved 8 February 2016, from http://www.wsj.com/articles/colombia-posts-3-2-quarterly-gdp-growth-1449767155

Finance & Development | F&D,. (2016). Finance & Development. Retrieved 5 February 2016, from http://www.imf.org/external/pubs/ft/fandd/basics/gdp.htm

Consumption patterns

Nowadays massive consumption is moving in a complex scenario, the economy is slowing down, the value of the dollar going up and the inflation rates are boosting up. During 2016 the household consumption will decline, making it hard for industries to produce goods and services because of the low demand of buying.

According to The World Bank, the household consumption in Colombia shows that 34.9% corresponds to the segment of food and beverages, being this one of the highest segment and allowing it to be an opportunity for grate advantage to our industry.Growing percentage of women in the workforce has increased the use of restaurants and the demand for new value-added products.

Consumption Patterns, help us to be update about how consumers preferences for goods and service.Population in Colombia consumes more than 50% in neighborhood sotres and bakery being this a good oportunity for our business.

References:

www.worldbank.org, T. (2016). Consumption | Country | The World Bank. Datatopics.worldbank.org. Retrieved 5 February 2016, from http://datatopics.worldbank.org/consumption/country/Colombia

Unemployment trends

“In Colombia, the unemployment rate measures the number of people actively looking for a job as a percentage of the labor force.”

This economic force is very important because organizations demand different factors to produce goods and services, and one of them is labor. This allows us to know if people are available for getting a job and to work with us. Colombia's minimum wage increases 7% this year 2016.

Unemployment Rate in Colombia increased to 8.60 percent in December from 7.30 percent in November of 2015, according to DANE (Colombia Statistics Bureau). “This dynamism in the labor market is proof of the ability of the Colombian economy to create jobs and absorb the increasing labor supply, says the ministry.”

References:

Moss, L. (2015). Colombia’s Unemployment Rate Falls to Lowest Ever 8.9%. Finance Colombia. Retrieved 4 February 2016, from http://www.financecolombia.com/colombias-unemployment-rate-falls-to-lowest-ever-8-9/

Worker productivity levels

The productivity in Colombia is one of the lowest in the region. The worker productivity levels are so low that is required 4,5 workers to do the same job as one worker in the United States.

This force is important because it shows us if people are really motivated at work, if they are productive and we can analyze how this affects the results of the industry or company. This force shows us that the situation about worker productivity levels in Colombia are alarming because we as a company are looking for motivated people that can give us the efficiency and capacity that we need.

References:

Dinero.com,. (2015). Productividad en Colombia es de las más bajas de la región. Retrieved 17 February 2016, from http://www.dinero.com/pais/articulo/productividad-laboral-colombia-mas-bajas-america-latina/205142

Value of the Dollar in World Markets

May 15, 2016

The Colombian peso has depreciated more than most predicted; One dollar is now worth a little bit more than COP 3, 300.

The price of the dollar in Colombia has been increasing, making our inflation rate, gained value and hurting the wallets of many Colombian citizens.

“This plunge could benefit areas of the nation’s export sector however, as Colombian goods will now be cheaper and more competitive globally.”

The value of the dollar affects our importations rate, causing items to become more expensive and making it harder for people to bring products from foreign countries.

References:

Colombiareports.com,. (2015). Colombia's peso sinks further; US dollar now at COP3,300 and really causing issues. Retrieved 3 February 2016, from http://colombiareports.com/colombias-peso-sinks-further-us-dollar-now-worth-more-than-cop3300/

The Bogota Post,. (2015). Guide to the ups and downs of the Colombian peso. Retrieved 3 February 2016, from http://thebogotapost.com/2015/08/24/guide-to-the-ups-and-downs-of-the-colombian-peso/

Stock market trends

The stock market show to us if a company is being worth because of their products and services.

"Many factors affect prices in the stock market such as the inflation, interest rates, energy prices, oil prices and international issues (War, Crime and many more), all those aspects change the way how companies manage their Economy to not waste materials."

The stock market is where buyers and sellers meet to decide on the price to buy or sell securities, usually with the assistance of a broker.

The government of Colombia have a basic introduction to this "study" how, when and why to invest in the stock market; which shows how this system works along the year, they also say that we as citizens we should invest in various companies, but the experts have a different perspective that invest is dangerous if you don't know about what you're about to do

In our company it can show us some graphics with the evolution of the economy, sales and many more. Also it is a factor that its very significant to us, because we need to know what people are demanding and what we can do for supply those needs, this gives us a better view of the important items in the economy.

References:

Bvc.com.co,. (2016). Bolsa de Valores de Colombia, Un país todos los valores. Retrieved 12 February 2016, from https://www.bvc.com.co/pps/tibco/portalbvc/Home/Empresas/Empresas/Documentos+y+Presentaciones

Businesstoday.in,. (2016). Technical tools used to predict stock market trends. Retrieved 5 February 2016, from http://www.businesstoday.in/stocks/technical-analysis-tools/story/21155.html

Tradingeconomics.com,. (2016). Colombia Stock Market (IGBC) | 2010-2016 | Data | Chart | Calendar. Retrieved 5 February 2016, from http://www.tradingeconomics.com/colombia/stock-market

Foreign countries’ economic conditions

The state of the economy in a country or region. Economic conditions change over time in line with the economic and business cycle, as an economy goes through expansion and contraction. Economic conditions are considered to be sound or positive when an economy is expanding, and are considered to be adverse or negative when an economy is contracting.

A country's economic conditions are influenced by numerous macroeconomic and microeconomic factors, including monetary and fiscal policy, the state of the global economy, unemployment levels, productivity, exchange rates, and inflation and so on.

In our company this might affect the way how we sell our products because of the change of coin but also will make a stronger company to plan different strategies to not fall into a bankruptcy, as well the state of the economy in a country also helps our company to have a little more of income.

References:

Investopedia,. (2011). Economic Conditions Definition | Investopedia. Retrieved 3 February 2016, from http://www.investopedia.com/terms/e/economic-conditions.asp

Import/Export factors

The import and export business is an ideal occupation for those individuals who know how to sell, but who also have a diplomatic and engaging character. As sales and distribution agents in one or more countries for overseas manufacturers, importers and exporters are the matchmakers of international trade. Import and export are high-risk businesses that are vulnerable to sudden changes in politics, economics and legislation.

The changes in the exportation and importation are mainly hard to predict those are the natural disasters, non-payment, the life-span of the goods, and many more.

In our company since the tea is being produced in various countries we can have more options to buy and sell to, but the main one its Taiwan and the products are being shipped to make the final product to consume and sell.

The risk to import or export goods to another countries is that sometimes the ships may have to stop because of different reasons, and the goods might get rotten or damaged because of the movement.

Imports in Colombia decreased to 4.24 USD Billion in November from 4.52 USD Billion in October of 2015.

Exports in Colombia increased to 2.54 USD Billion in December from 2.36 USD Billion in November of 2015.

References:

Tradingeconomics.com,. (2016). Colombia Imports | 1980-2016 | Data | Chart | Calendar | Forecast | News. Retrieved 5 February 2016, from http://www.tradingeconomics.com/colombia/imports

Small Business - Chron.com,. (2016). What Can Affect an Import and Export Company?. Retrieved 4 February 2016, from http://smallbusiness.chron.com/can-affect-import-export-company-43130.html

Demand shift for different categories and services

The key to making the most profit for your business means accurately estimating demand for your products or services. Calculating demand involves an intricate balance that includes supply and pricing, as well as correctly reading customer wants and needs.

Income, prices, preferences, expectations and population shifts are the main aspects that change how we can get our products and services, this demands go hand on hand with the import/ export factors but in a deeper look for the customers.

In our company this can show what kind of flavor does the consumer likes and buys the must, with that prices change for the flavors that are not being consumed in high quantities and if those can change when they are shifted to another country.

References:

Small Business - Chron.com,. (2016). What Are the Four Factors That Cause a Shift in Demand?. Retrieved 4 February 2016, from http://smallbusiness.chron.com/four-factors-cause-shift-demand-56212.html

Income differences by region and consumer groups

Income inequality has risen in most countries in the world over 2006-2011, driven by rapid population ageing, rising unemployment and government spending cuts in advanced economies, and urban/rural and skills divides in developing countries. Rising income inequality is changing consumer spending patterns and creating substantial opportunities for adaptable businesses, although it can also undermine a country’s business environment and growth potential.

Gini index measures the extent to which the distribution of income (or, in some cases, consumption expenditure) among individuals or households within an economy deviates from a perfectly equal distribution.Countries with very high 2011 income indices include Ecuador (59.2%) and Colombia (58.3%).

Our company being located in one of the countries with the most inequality we must work with people from every financial status to make a change.

References:

Data.worldbank.org,. (2016). GINI index (World Bank estimate) | Data | Graph. Retrieved 4 February 2016, from http://data.worldbank.org/indicator/SI.POV.GINI/countries/CO?display=graph

Kasriel-Alexander, D., Boumphrey, S., & Bremner, C. (2012). Income Inequality Rising Across the Globe. Euromonitor International Blog. Retrieved 6 February 2016, from http://blog.euromonitor.com/2012/03/special-report-income-inequality-rising-across-the-globe.html

Price fluctuations

The change of prices because of political means change the way companies sell their products adapting and every time changing against the rival company, this prices can be higher or lower depending of the economic state.

Our company must change every time this kind of problems happen, also to be prepared if something goes wrong this makes a perfect time to make financial plans.

References:

TheFreeDictionary.com,. (2016). Price Fluctuation. Retrieved 3 February 2016, from http://financial-dictionary.thefreedictionary.com/Price+Fluctuation

Tradingeconomics.com,. (2016). Colombia Food Inflation | 1988-2016 | Data | Chart | Calendar | Forecast. Retrieved 6 February 2016, from http://www.tradingeconomics.com/colombia/food-inflation

Export of labor and capital from Colombia

Labor it’s one of the main sources of sustainability to a company as well as the capital, when a company it’s big enough to open a new stand in another country the main Officine must send a determinate amount of money which must be used to “survive” but the new stand must be able to sell like in the main country, Export labor also it’s a good sign that the company is growing to make possible to various workers to life in another countries.

In our company if we make possible to export labor and capital to another country, we must prepare the workers to impress the best way possible in this new area; also makes us a little bit known in another place; how this can affect our company, if the sales aren’t being profitable to sustain the new stand and therefore adapt to the market

References:

Migrationpolicy.org. (2004). Labor Export as Government Policy: The Case of the Philippines. Retrieved 8 February 2016, from http://www.migrationpolicy.org/article/labor-export-government-policy-case-philippines

Monetary policies

“Monetary policy is how central banks manage the money supply to guide healthy economic growth.The primary objective of monetary policy is to reach and maintain a low and stable inflation rate, and to achieve a long-term GDP growth trend.”

“Central banks reduce inflation by raising interest rates, selling securities through open market operations, and other measures to reduce liquidity.”

Consumer prices in Colombia increased 7.45 percent year-on-year in January of 2016, the highest since December of 2008. Inflation Rate in Colombia is expected to be 7.68% at the end of this quarter of 2016 accoridng to Trading Economics global macro models and analysts expectations.

Inflation is an economic force to which we should be aware of, in order to have contingency plans and avoid the consequences those could bring us in the future. The board of directors of the Bank of the Republic determines the monetary policy with the objective of maintaining inflation around their goal of 3% long-term.

For our industry, it is alarming how the inflation rate it’s increasing because there will be a raise in the prices of goods producing an increase on the price of the products we are selling. Besides there will be an increase dissatisfaction among workers as they demand higher wages to sustain their present living standard.

References:

Amadeo, K. (2016). Only Central Banks Legally Create Money Out of Thin Air. About.com News & Issues. Retrieved 3 February 2016, from http://useconomy.about.com/od/glossary/g/Monetary_policy.htm

Tradingeconomics.com,. (2016). Colombia Inflation Rate | 1955-2016 | Data | Chart | Calendar | Forecast. Retrieved 3 February 2016, from http://www.tradingeconomics.com/colombia/inflation-cpi

Banrep.gov.co,. (2016). Monetary Policy | Banco de la República (banco central de Colombia). Retrieved 3 February 2016, from http://www.banrep.gov.co/en/taxonomy/term/5838

Fiscal policies

“Fiscal policy is the use of government spending and taxation to influence the economy. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty.”

Fiscal policies impact essentially every individual and business in the nation, therefore this economic force is crucial for our small business and it is really important to understand. The fiscal policy is often used to encourage or stabilize consumer spending for a healthy economy, if the government sets policies for the citizen’s welfare (easing loan rates, investing in bonds and in financial security) this can result in consumer confidence and spending and it would be a benefit for our company’s incomes.

In our industry this economical force is fundamental because it can help us progress or cease the flow of our company. In Colombia there have been different fiscal benefits for creating new businesses. The Law 1429 de 2010 provides benefits and incentives to the entrepreneurs to reduce costs and supporting them in growing their businesses.

References:

Bogotá, C. (2016). Todo sobre la Ley 1429 de 2010. Ccb.org.co. Retrieved 8 February 2016, from http://www.ccb.org.co/Inscripciones-y-renovaciones/Todo-sobre-la-Ley-1429-de-2010

Horton, M. (2016). Finance & Development. Finance & Development | F&D. Retrieved 8 February 2016, from http://www.imf.org/external/pubs/ft/fandd/basics/fiscpol.htm

Dinero.com,. (2015). En Colombia sí paga crear empresa. Retrieved 5 February 2016, from http://www.dinero.com/especiales-comerciales/5000-empresas-2015/articulo/en-colombia-si-paga-crear-empresa/209544

Tax rates

Tax rate is the percentage at Which an Individual or corporation is taxed. The tax rate is the tax imposed by the federal government and some states based on an Individual's taxable income or a corporation's earnings. There are so many tax rates in Colombia like Retefuente (0,1%-20%), ICA (4,14%-13,8), 4 x 1000, Iva (16%) etc.

This factor affects our beverage industry because the government collects taxes without exception, and is something that should be reconsidered when launching a new product, or also acquire some assets.

In October 2014, the government presented a series of tax changes to meet its fiscal targets in 2015, which will increase corporate income taxation. This could impact investment decisions, either by firms postponing decisions due to uncertainty on the final tax burden or by essentially raising the cost of investment.

Also this would have an effect to our company as the taxation rates are increasing for the industry also.

References:

OECD Economic Surveys Colombia. (2016) (1st ed.). Retrieved from http://www.oecd.org/eco/surveys/Overview_Colombia_ENG.pdf

European Economic Community (EEC) policies

European Economic Community (EEC), former association designed to integrate the economies of Europe.

The EEC was designed to create a common market among its members through the elimination of most trade barriers and the establishment of a common external trade policy. The treaty also provided for a common agricultural policy, which was established in 1962 to protect EEC farmers from agricultural import

Our market tea-based drinks would not be involved in this economic strength, basically the product idea is adapted from an Asian product, which should only be imported exclusively seed asia.

References:

Encyclopedia Britannica,. (2014). European Community (EC) | European economic association. Retrieved 4 February 2016, from http://www.britannica.com/topic/European-Community-European-economic-association

Organization of Petroleum Exporting Countries (OPEC) policies

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member Countries. OPEC seeks to ensure the stabilization of oil prices in international oil markets.

This organization (OPEC) represents an economic force, which would have a big impact in our market tea drinks, this because oil is the raw material for many products, as well as transportation services. Any decision of this organization could make our products have price variations, and so somehow have a kind of volatility in the market, which is not suitable for a new product.

References:

Jodidata.org,. (2016). Organization Of The Petroleum Exporting Countries (OPEC) | JODI. Retrieved 6 February 2016, from https://www.jodidata.org/about-jodi/partners/opec.aspx

Coalitions of Lesser Developed Countries (LDC) policies

The policies that are managed in underdeveloped countries are difficult to handle, since they do not have political autonomy or also no concrete policies, in order to have a good use of markets. Also another difficulty of doing business with these countries is their lack of quality, safety, political leadership, etc.

This indicator does not affect our company tea-based beverages, since it would negotiate only with reference large Asian countries like China, Malaysia, Indonesia, Thailand, etc.

References:

FALTA REFERENCIA